By: Ms Menggelisha

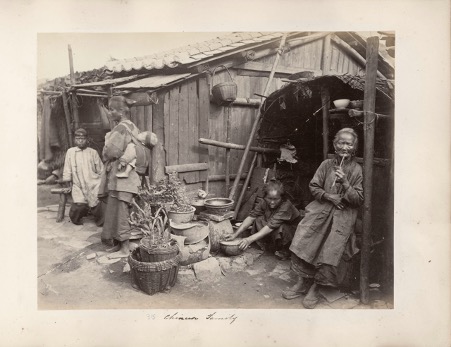

In the fading days of the Qing Dynasty, a poignant ballad portrayed the struggles of a Chinese family trapped in the unrelenting cycle of survival. “The father crafting lanterns, the mother aiding in tooth extractions, the son toiling as a servant, and the daughter threading as a tailor. Despite their unwavering efforts to make ends meet, the shackles of poverty clung stubbornly to their doorstep.” Consider the similar plight faced by the Chen family in suburban Canton. With an annual income of less than £11 a year, they were forced to plunge into a pound of debt after basic expenses. In times of famine, desperation even pushed them to unthinkable measures, like selling their own children. Meanwhile, across the seas, British farmers thrived, pocketing £11 in savings after a year of living.

Source: John Thomson, Suburban Residents in Canton, 1869, photograph album, 28×35.5 cm (National Maritime Museum, London).

These lives of ordinary people collectively revealed a macroeconomic phenomenon known by economic historians as the “Great Divergence” between Europe and Asia. In the 18th century, a noticeable gap in living standards emerged between the industrialised European economies and the sluggish Chinese economy. Such gap continued and even grew during the late Qing Dynasty (1840-1912) and the Republican period (1912-1948). In the recent era of globalization since the 1980s, however, China had a remarkable growth spurt. Like a phoenix rising from the ashes, China’s story evolves into a recent trend of convergence, closing the historical gap with European productivity leaders.

Now that we understand what happened, let us dive into the heart of my research to find out “why”. It is an exciting adventure aimed at deciphering the “Sphinx’s new riddle” of Chinese growth. Why did growth happen after over a century of stagnation? Taking a retrospective expedition helps us to explore the proximate and ultimate causes of the Chinese falling behind UK and then catching up.

Here, I will introduce some of my research methods and findings with real-life examples for a clearer understanding. To set the stage for this discussion of growth factors, I shall define long-term growth as an improvement in production capacity rather than a shift in demand. Consider a simple toy industry that works like this: the manufacturer sources plastic from chemical plants, transforms it into toys, and ships the finished products to retailers for sale to customers. In a scenario where there’s a sudden surge in market demand for toys, short-term income may have a boost. The retailer, responding to increased demand, orders more toys from the manufacturer, who, in turn, requires additional plastic from chemical plants. However, chemical plants entail substantial investment and prolonged production timelines. Consequently, they cannot ramp up plastic production swiftly. This gives rise to the problems – an inflation in the toy market or, at the national level, trade imbalances. In contrast, when chemical plants and manufacturers adopt more efficient and innovative production processes, they can not only meet domestic demands but also gain a competitive advantage in the global marketplace. This advantage stems from lower production costs or distinctive product features, resulting in increased exports and sustained growth. Hence, short-term economic fluctuations are often tied to demands, whereas production capacity is the engine of long-term growth.

Keeping these ideas in mind, I examine the “troika” drivers behind Chinese growth in terms of production capacity, including capital stock, labour inputs, and technological advancement. In the toy industry example, better toy production can be achieved if the manufacturer has more machines (capital), skilled workers (labour), or uses automated processes (technology). Back to the Chinese situation, I observed consistent growth in capital and labour inputs since the late 19th century, but technological advancement only shifted from negative to positive in the 1980s. In simpler terms, during the century of stagnation, there was inefficient use or misallocation of the increase in capital and labour inputs. It is only in the recent growth miracle that these inputs have been effectively utilized with certain technological advancement.

I am currently working on comparing the long-term production capacity of China and the UK using Purchasing Power Parities (PPP). PPP helps in making a fair international comparison, considering that the same basket of goods may have different prices in different countries. To understand how PPP works, suppose that a toy costs £15 in the UK and ¥98 in China. To make an apples-to-apples comparison, the ¥98 is converted into pounds. If the exchange rate is such that the toy in China costs £10, then the PPP is 0.67 (10/15). I intend to create bilateral PPPs for each industry to examine which industries are more significant to the convergent trend and which ones are less important. My research is valuable because it facilitates a quantitative re-evaluation of China’s growth within a broader temporal and socio-economic framework, which has implications for current emerging economies as well as for future growth.